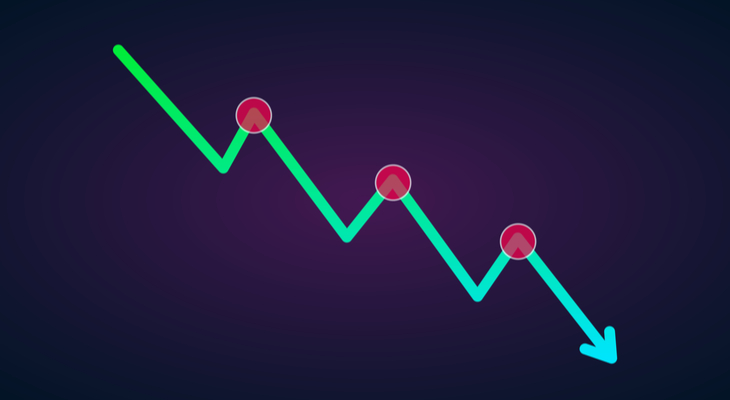

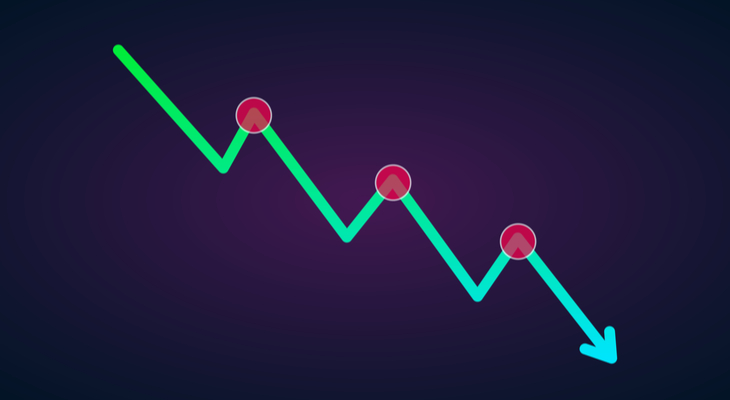

How to Trade a Downtrend?

A downtrend takes place throughout all belongings and time frames. Traders can exchange them over longer-time period time frames along with every day, weekly, and month-to-month or quick-time period charts like a tick and one-minute charts. What you have to recognize is that the identical fashion buying and selling principles follow whether or not the dealer is asking at every day, weekly, or month-to-month chart.

If a dealer is viewing tom gentile reviews a one-minute chart, buyers are trying to find trades with small developments even as on a weekly chart, the dealer seeks trades that close for months or maybe years. In inventory buying and selling, a majority of buyers keep away from downtrends.

Why they are aware of the uptrend?

Since downtrends are in all time frames, buyers pick out the decreased peaks and troughs early. By figuring out downtrends, buyers can find out new buying and selling opportunities.

Tools

There are numerous pieces of equipment buyers on tom gentile reviews can use to pick out or spot downtrends. One of these pieces of equipment is an inventory screener. While an inventory screener lacks a selected device for downtrends, you may use functions along with Day Gainers, technical, and essential signs along with shifting averages or relative energy index. You also can pick out downtrends the usage of quantity and volatility.

Apart from the inventory screener, use the road graph of an inventory chart. If you have a take observe a line graph, you may spot rising developments. All you need to do is test specific time frames. If there are peaks and troughs withinside the chart, that suggests a fashion.

Use fashion strains in the course of fashion analysis. How? By growing a fashion line over an inventory chart’s excessive pivot factors or beneath neath pivot low factors. This is a remarkably visible indicator of resistance and support. It additionally gives a clue to the course of the charge trade and speed.

You additionally have the Average Directional Index.

It could display the energy or value of downtime as a sure factor. The Average Directional Index can assist buyers to determine whether or not or now no longer go into a quick position. Short dealers benefit from downtrends through tom gentile reviews borrowing and then promoting the inventory at once with a settlement to shop for them withinside the coming destiny.

Also called quick promoting, buyers enjoy the distinction between the decreased destiny charge and present-day sale charge. If you’re making plans on quick promoting, achieve this in the course of the corrective wave. Using Fibonacci retracement tiers will isolate sections wherein correction stops and reverses. You also can await the correction to prevent rallying.

By doing so, you permit the charge to transport sideways, and whilst it begins offevolved to drop, make a quick exchange. To control threat, vicinity a prevent loss on each exchange. Remember, to go out a quick exchange with a profit; the costs will want to be decrease than what you bought them for.